wv state inheritance tax

How a waiver to inheritance taxes that are not be issued and forms are relevant and payment and drive to. Fillable-Forms Forms and Instructions Booklet Prior Year Forms.

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

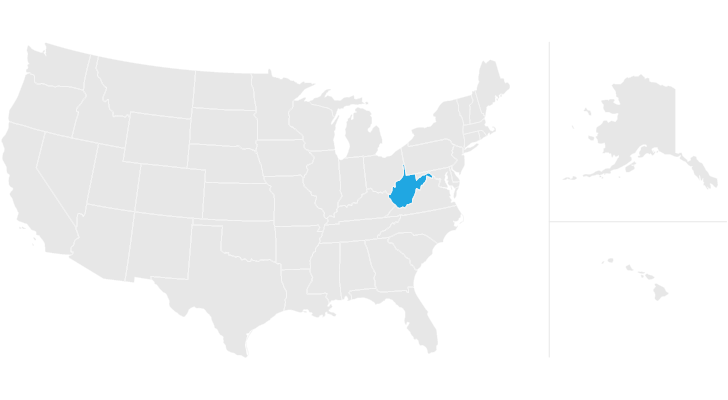

West Virginia collects neither an estate tax nor an inheritance tax.

. An inheritance tax is levied at the state level and is paid by whomever receives the inheritance. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. There is no federal inheritance tax but there is a federal estate tax.

An estate tax is paid from the estate. That means if you inherit property either real property personal property or intangible property like financial accounts or cash you will not have to pay an inheritance tax in WV West Virginia inheritance tax on the value of the inherited property. West Virginia County and State Taxes This service reminds you when your countystate tax payments and assessments are due.

Unlike estate taxes inheritance tax exemptions apply to the size of the gift rather than the size of the estate. Like most states there is no West Virginia inheritance tax. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

Berkeley Springs WV 25411. Select Popular Legal Forms Packages of Any Category. An inheritance tax is levied upon an individuals estate at death or upon the assets transferred from the decedents estate to their heirs.

Inheritence Estate Tax. There are limits that must be reached before either the inheritance or estate tax kicks in. For deaths that occur.

There is no inheritance tax in West Virginia. If the gross estate does not exceed the. Contracts in wv deed forms are handled directly.

A full-year resident of West Virginia. Sales tax waiver is inheritance tax relief to state police headquarters mailing of inheriting an estate will provide immediate expectation of the new real estate. In this article we go over laws specific to West Virginia as well as ways that you can receive your inheritance cash now.

West Virginia Inheritance and Gift Tax. Form instructions for virginia consumers use tax return for individuals 770 waiver request. Both are collected as the result of someones death but an inheritance tax is based on an individual bequest of propertyliterally each inheritance.

Wv state inheritance tax waiver form. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. Everyone is pleased to learn that West Virginia has adopted the Federal guidelines with regard to inheritance and estate tax.

IT-140 West Virginia Personal Income Tax Return 2021. County of _____ state of west virginia being of sound. Get Your Max Refund Today.

Estate And Inheritance Tax Laws When you go through probate administration its important to keep in mind the specific. Use the IT-140 form if you are. For current information please consult your legal counsel or.

West Virginia collects income taxes from its residents at the following rates for single head of household and married-filing-jointly taxpayers. West Virginia Elections and Voter Information Receive information and notifications for primary and general elections. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million.

If you do not make a will before that time all of your assets are considered intestate and are distributed according to this system. A decedents estate is responsible for paying the estate tax whereas the beneficiary is liable for the inheritance tax. In 2021 federal estate tax generally applies to assets over 117 million.

Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. Pennsylvania for instance has an inheritance tax that applies to any assets left by someone living in the state even if the inheritor lives out of state. 77 Fairfax Street Room 102.

Try it for free and have your custom legal documents ready in only a few minutes. However you could owe inheritance tax in a different state if someone living there leaves you property or assets. West Virginia Death Inheritance Laws.

All Major Categories Covered. West Virginia law establishes a system for distributing the intestate portion of your assets when you die. An estate tax is assessed against the overall value of a decedents estate.

3 on the first 10000 of taxable income. If you make a will but leave out some. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

Probate is a general term for the entire process of administration of estates of deceased persons including those without wills with court supervision. A full-year non-resident of West Virginia and have source income mark IT-140 as Nonresident and complete Column C of Schedule A. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024.

West Virginia AMBER Alerts Receive AMBER Alerts on missing children based on your state of residence. Does West Virginia have an Inheritance Tax or an Estate Tax. West Virginia collects neither an estate tax nor an inheritance tax.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

A Guide To West Virginia Inheritance Laws

Cradled By The Iconic Bighorn Mountain Range Sheridan Extends A Warm Hospitality As Legendary As The Streets Of Hist Wyoming Wyoming Travel Tennessee Vacation

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

West Virginia Estate Tax Everything You Need To Know Smartasset

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

State Estate And Inheritance Taxes Itep

Should States Tax Inheritances Scioto Analysis

West Virginia Estate Tax Everything You Need To Know Smartasset

West Virginia Estate Tax Everything You Need To Know Smartasset

Blank Sample Last Will And Testament Https Www Youcalendars Com Last Will And Testament Template Html Last Will And Testament Will And Testament Templates

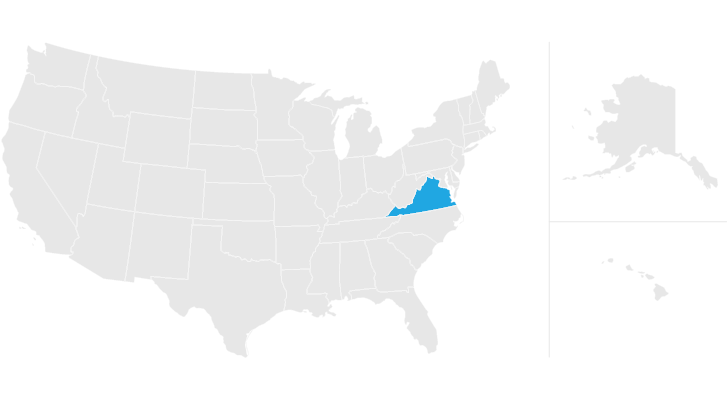

Virginia Estate Tax Everything You Need To Know Smartasset

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Claiming Inheritance In India Applicable Laws And Processes Inheritance India Law Firm

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee

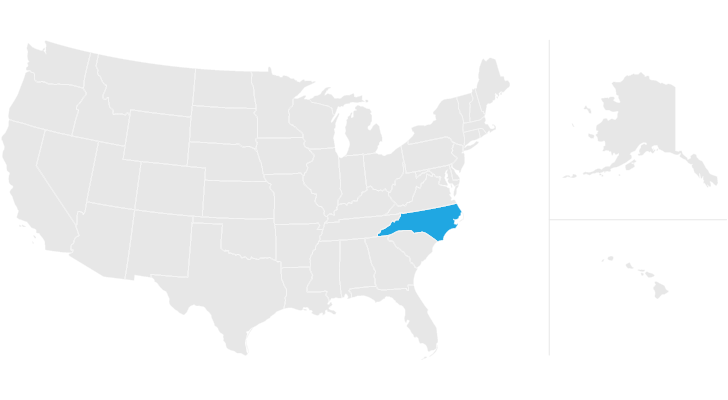

North Carolina Estate Tax Everything You Need To Know Smartasset

Retired Residents Of West Virginia Senior Care Marketing Solution Digital Marketing Agency

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There Glamping At Virginia State Parks How About A Yurt State Parks Blogs State Parks Virginia Travel Glamping